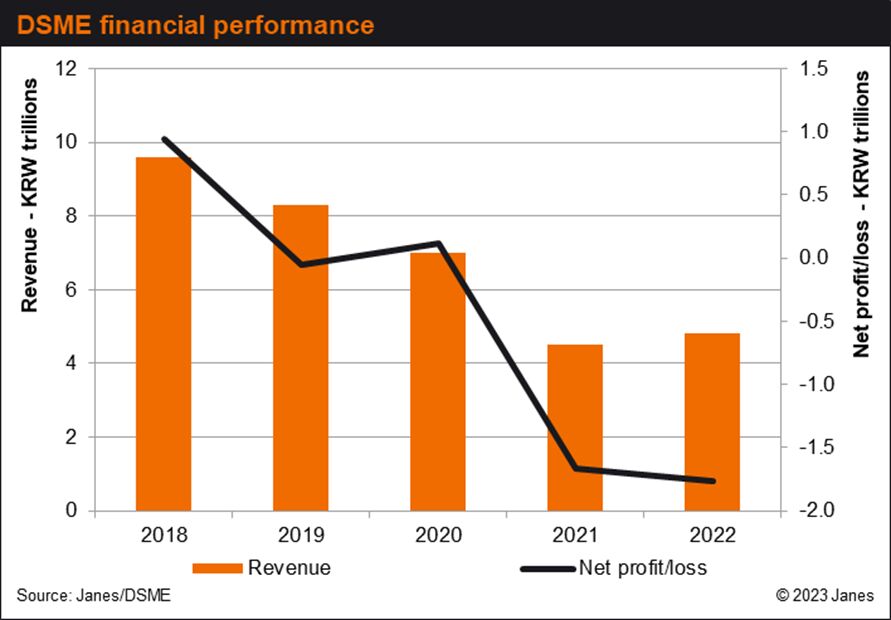

DSME's financial performance has continued to deteriorate in recent years amid efforts by the state-run Korea Development Bank to find a buyer for the naval shipbuilder. (Janes)

South Korea's Fair Trade Commission (FTC) has approved the Hanwha Group's proposed acquisition of a controlling stake in Daewoo Shipbuilding & Marine Engineering (DSME), one of the country's biggest naval shipbuilders.

The FTC announced on 27 April that it has approved a deal in which Hanwha Group subsidiaries – including its defence businesses, Hanwha Aerospace and Hanwha Systems – will acquire a 49.3% stake in the financially troubled shipbuilder.

The acquisition, which is expected to be completed in May, will be worth KRW2 trillion (USD1.49 billion).

The FTC said that several conditions apply to the deal. These include a ban on Hanwha selling naval ship systems and components to DSME at discriminatory low prices. Hanwha is also required to allow government access to naval ship technologies owned by DSME.

Hanwha and DSME are also required to adhere to several non-disclosure obligations linked to the deal. The conditions will be in place for three years after the conclusion of the acquisition, said the FTC.

Hanwha had not responded to Janes questions at the time of publication.

Hanwha signed a preliminary agreement with DSME in September 2022 to facilitate the acquisition. Since then, the deal has been approved by anti-trust regulators in several regional states – including the United Kingdom and the European Union (EU) – where both Hanwha and DSME businesses are active.

Hanwha will acquire the DSME stake from the shipbuilder's primary creditor, the state-run Korea Development Bank (KDB) whose shareholding in DSME will reduce to about 28%.

Looking to read the full article?

Gain unlimited access to Janes news and more...