This edition of the Belt and Road Monitor covers developments from 1 to 31 October. If you enjoy our Belt and Road coverage, consider checking out Janes visual analytic tool that tracks and maps the global activities of Chinese and Russian companies in real time and includes expanded analysis of projects highlighted in "Top Developments."

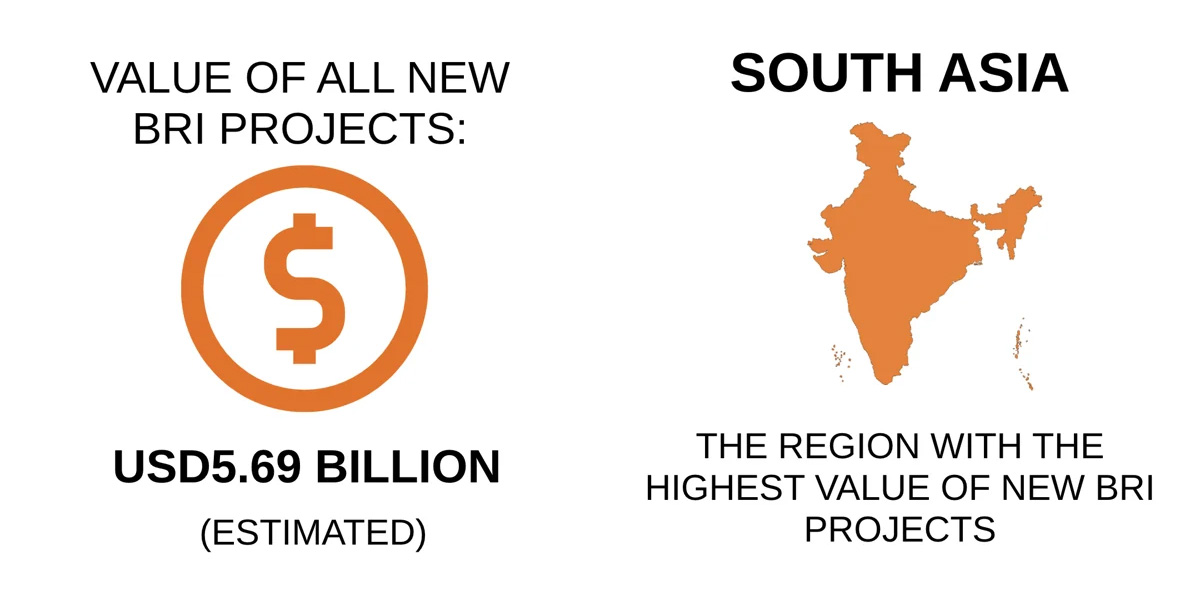

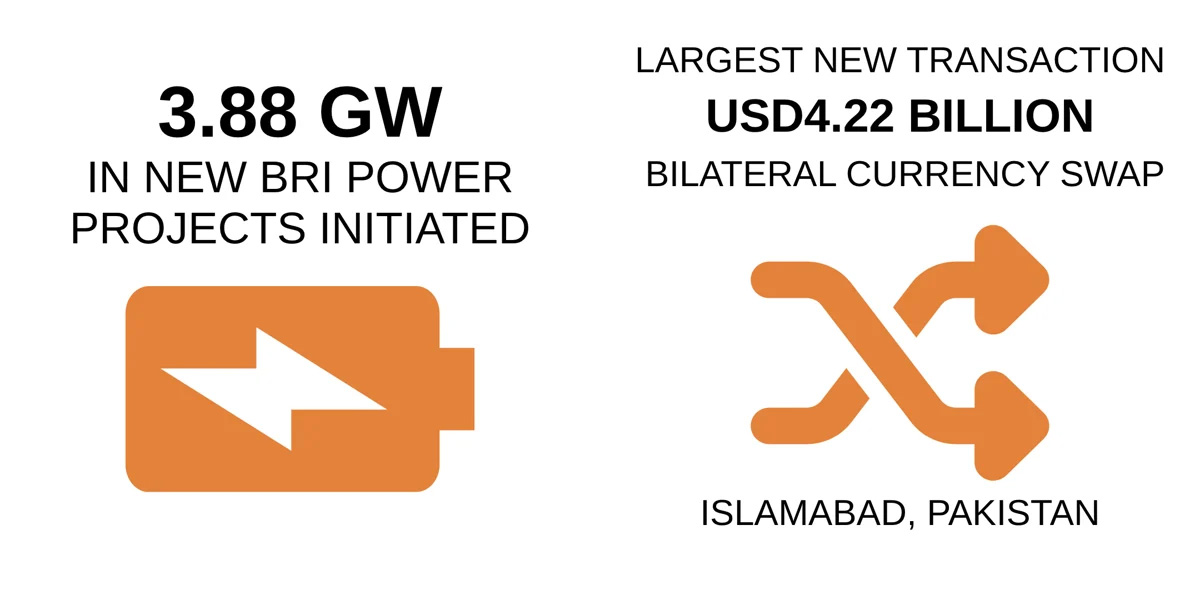

Belt & Road at a Glance

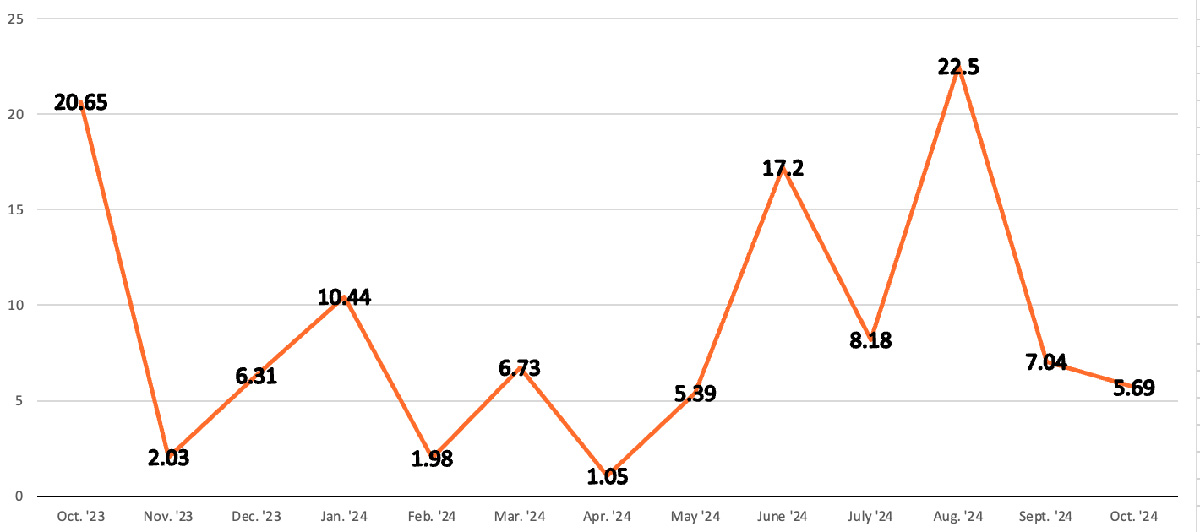

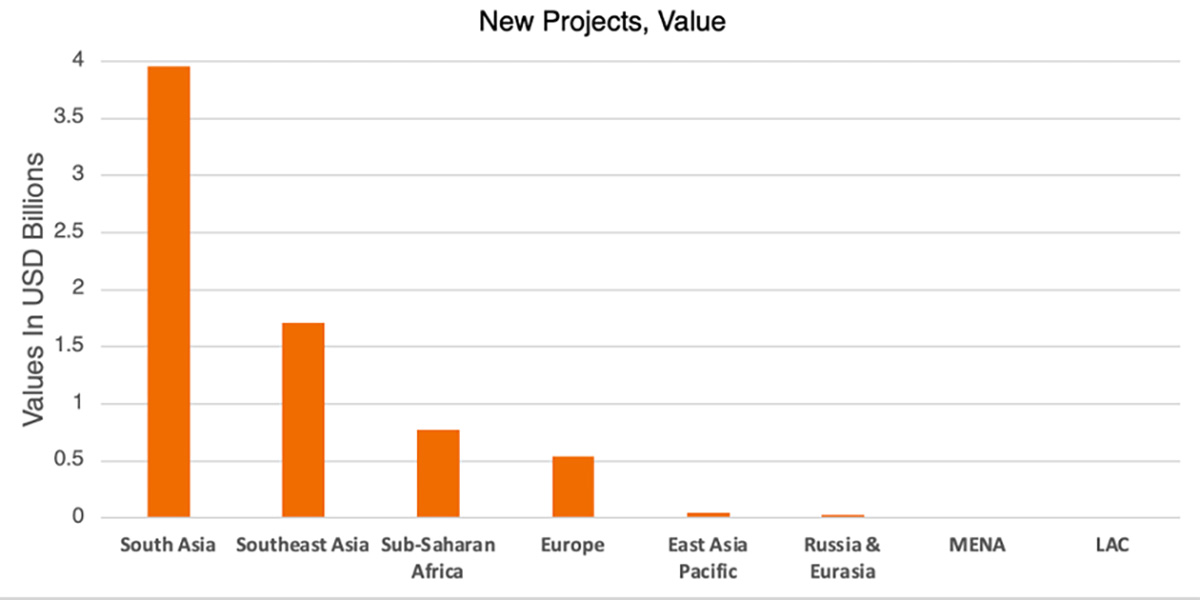

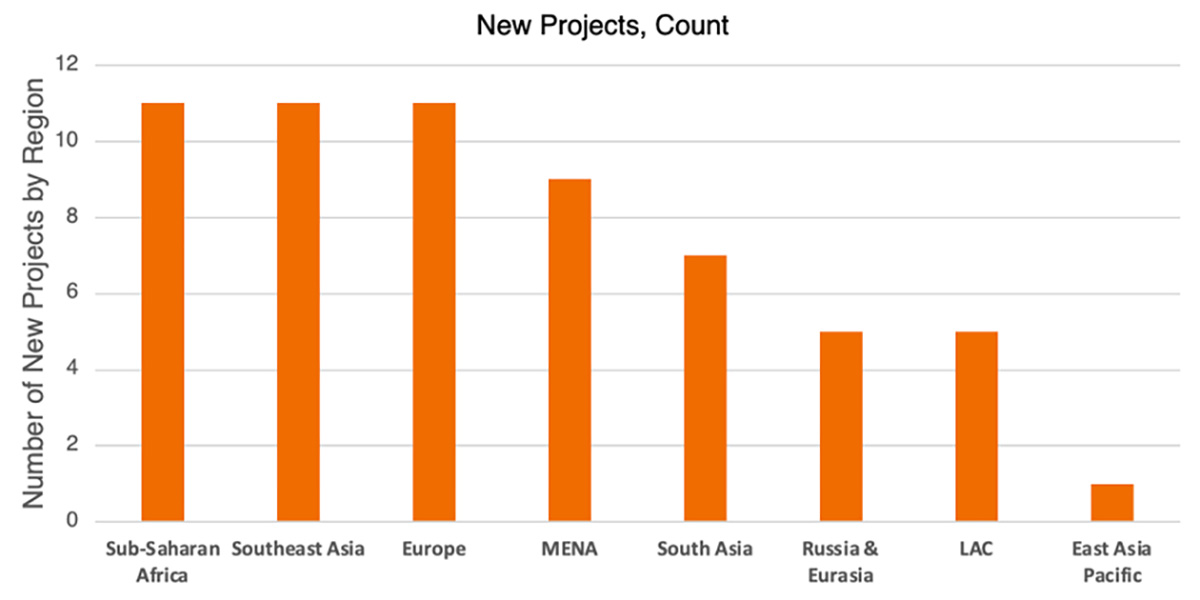

Chinese BRI Transactions in USD Billions

Graph notes: These transactions include Chinese loans and grants but also contracts and subcontracts. Not all transactions will come to fruition, and this graphic does not account for cancellations, disruptions, failure to disburse funds, etc. This depicts the announced values of transactions with involving Chinese entities operating overseas, which could include Chinese funded projects but also foreign funded projects involving Chinese contractors, across multiple BRI-linked sectors.

Top Developments

China's SSST Lays the Groundwork for Market Expansion of Satellite Internet in Kazakhstan and Russia

On 7 October 2024, Kazakh media reported that government-backed Shanghai Spacecom Satellite Technology (SSST) plans to build a ground network and provide high-speed broadband internet in Kazakhstan. SSST is expected to start offering its services to government and private clients in Kazakhstan by 2026. SSST, a Chinese satellite internet provider, will face global competition in Kazakhstan since international companies are already present or have formalised plans for market entry including US-based Starlink Services. Kazakh companies in the energy, mining, and logistics fields are likely primary beneficiaries. SSST in September took initial steps to enter the Russian market, registering its Spacesail brand with the Russian Federal Service for Intellectual Property (Rospatent), indicating SSST’s future intentions.

Huawei Partners with National Bank of Pakistan to Modernise Bank Technology

On 9 October 2024, Huawei signed an MoU with the National Bank of Pakistan (NBP) to develop a national cloud data centre. NBP is a subsidiary of the State Bank of Pakistan (SBP), the country’s central bank. In 2020, SBP declared NBP to be one of the country’s three systematically important financial institutions, meaning that a failure of one of these institutions could have serious financial implications and the institution’s actions have a significant impact on domestic economic growth. Data centres house an entities’ technology hardware and computer infrastructure and, in this instance, could give Huawei access to significant sensitive financial information.

China’s Xinhua News Forms Media Partnership with Iran

On 14 October 2024, Xinhua news agency signed a memorandum of understanding (MoU) with Mehr Media Group, which owns both Mehr News Agency and the Tehran Times. Both Xinhua and Mehr News Agency are state-backed news organisations. The agreement is aimed to increase co-operation between the two entities and will support the dissemination of official state narratives in each country. The agreements were signed at an international media forum hosted by China in Xinjiang.

China Developing USD1.5 Billion Highway in Cameroon with Links to the Douala Port

Reports of 14 October 2024 announced that China First Highway Engineering Corporation has started developing the second phase of a highway linking the Cameroonian capital of Yaoundé with the port city of Douala. This project phase will connect Bibodi and Douala and is expected to cost USD1.5 billion to construct the 140 km route. The Douala port processes around 85% of the country’s trade and is the busiest access point for goods shipped to and from Central Africa.

COSCO Shipping Ports Acquires Stakes in Laem Chabang Terminals, Expanding Port Equity in Southeast Asia

On 23 October 2024, COSCO Shipping Ports (CSP) announced equity stakes in two container terminals at Thailand’s largest and busiest port, Laem Chabang; CSP’s second regional port holding after Singapore. Laem Chabang is a deepwater port that handles the majority of Thailand’s throughput. CPS’s ownership stakes at the facility represent a USD110 million investment in strategic assets in Southeast Asia, with a 12.5% stake in Thai Laemchabang Terminal Co., Ltd. (TLT) and 30% in Hutchison Laemchabang Terminal Ltd. (HLT). As of 2022 and 2023, the HLT terminal was loss-making while the TLT terminal had a modest profit during those same years of less than USD1,500 per annum.

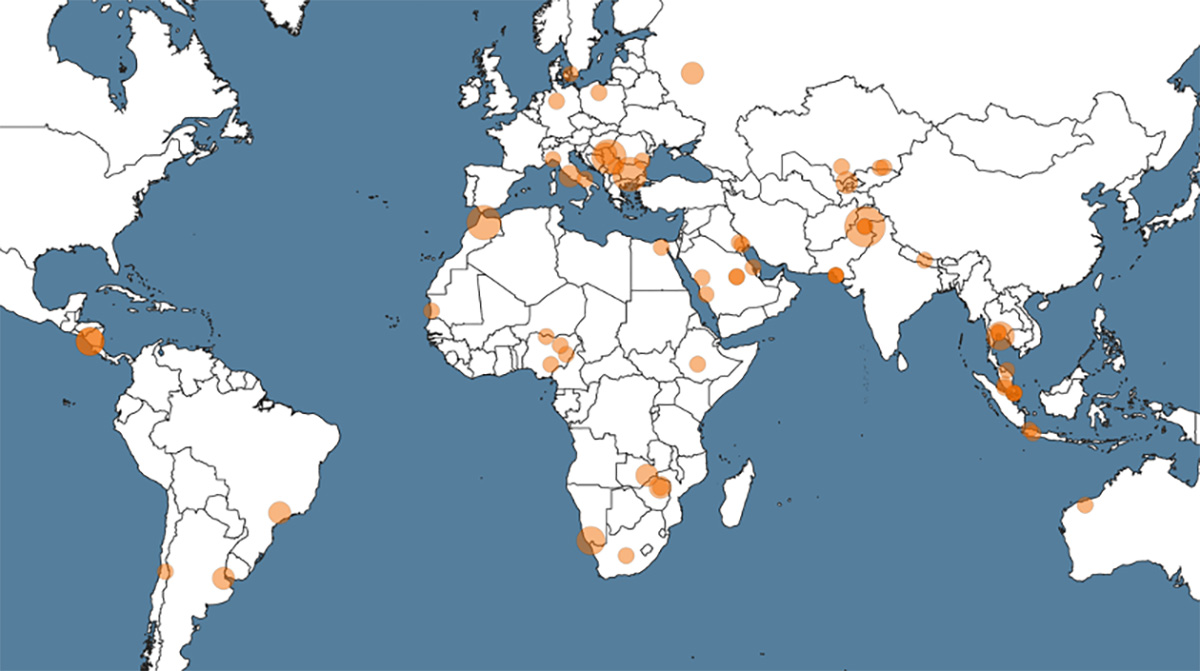

New Project Locations

What They're Saying

AUDRYE WONG, Jeane Kirkpatrick Fellow, American Enterprise Institute

On the differences between Chinese and Russian "informational" statecraft.

“…China’s informational statecraft differs from Russia in a few respects. Beijing generally prefers to tout a specific pro-China message, while Moscow often seeks political destabilization and disruption. Thus far, Russia’s tactics have been more sophisticated; for example, targeting subgroups with tailored messaging, and being more willing to let internet memes evolve organically on social media. China’s efforts tend to focus on “spamming” their narrative, are more reactive and ad hoc, and are less inclined to let narratives evolve on their own.”

By the Numbers

The Monitor draws from transactional data collected daily by our proprietary tool, Janes IntelTrak, as well as research compiled by our team of analysts. Contact us today for a demonstration.